Comprehensive Credit Reporting (CCR) is restructuring how customer credit information is reported to credit reporting bodies such as Equifax.

Comprehensive Credit Reporting was introduced as of 1 July 2018. CCR allows creditor providers and lenders to gather a more complete picture of a customer’s financial state. The purpose of this is to allow lenders to make more informed and responsible lending decisions.

Out with the old, in with the new.

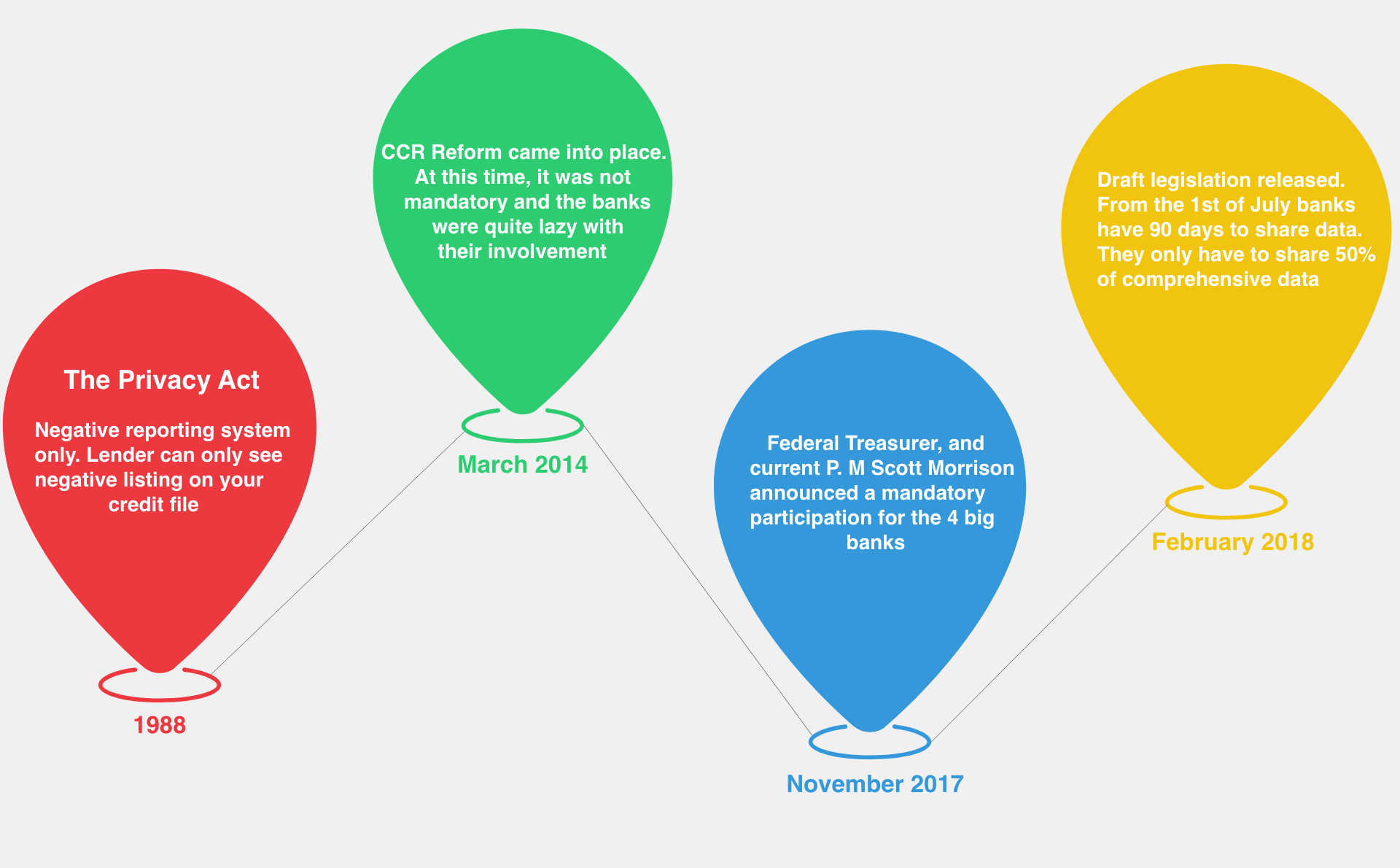

Australia’s credit reporting systems has drastically changed over the past few years. This change in credit reporting has largely resulted from legislative reform.

Before Comprehensive Credit Reporting was put in place, the credit file of a person was largely confidential. The detailed financial history of a person was governed by the Privacy Act. Lending and financial institutions had access to very little negative information such as bankruptcies and defaults.

Evolution of Comprehensive Credit Reporting in Australia

What does this mean for lenders?

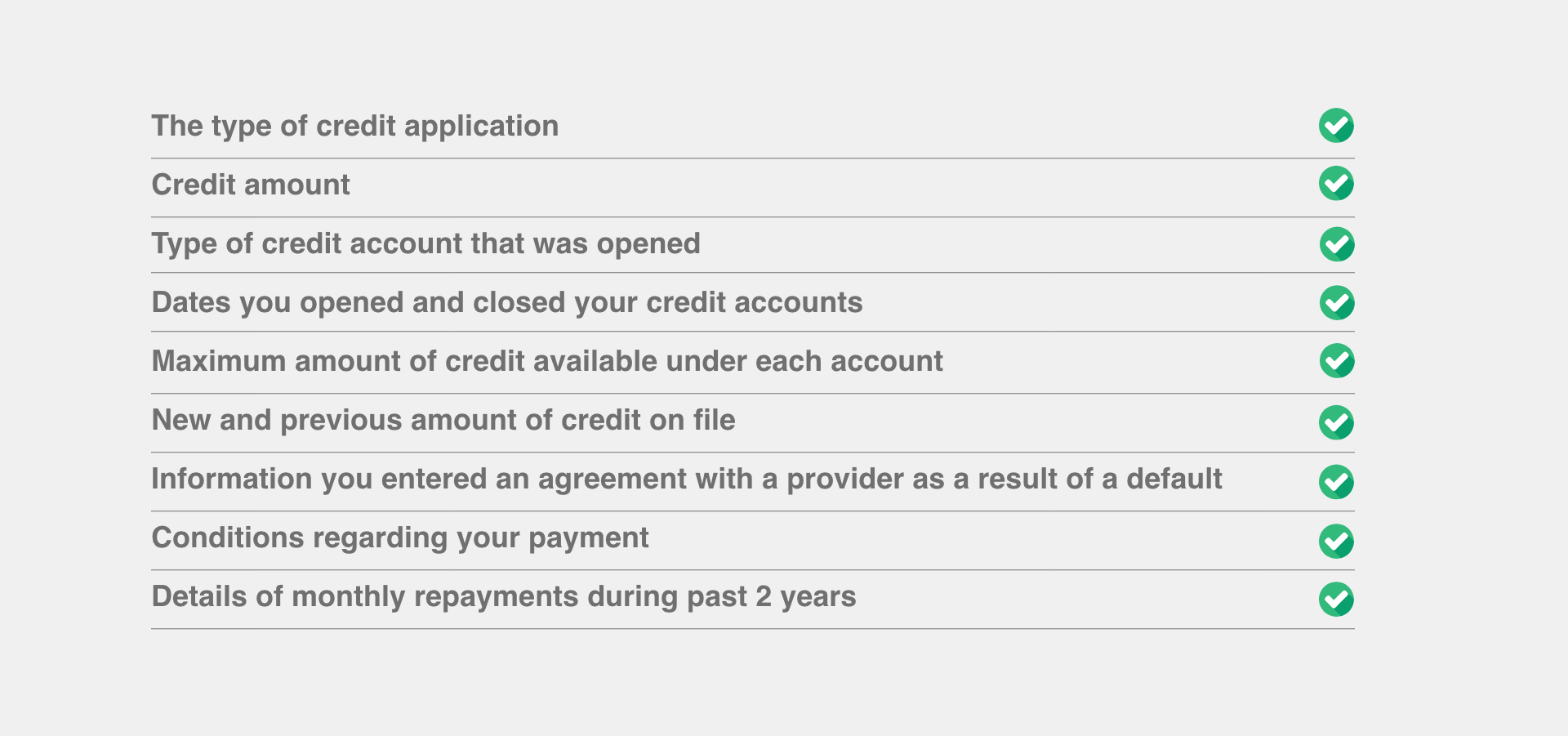

Lenders can now share more data with credit reporting bureaus such as Equifax and Experian. Along with personal and public information that was already available, a lender will now have access to the following list of information.

What does it mean for you?

Missed or late payments can impact your score

In this new system, your credit report will outline whether you have missed or made a late payment. In the past model, this was not the case. Only defaults or serious credit infringements would appear on your credit report. Whilst some banks have “grace” periods, typically if a payment has been missed by more than 5 days it may be recorded on your credit file. A default, however, will not be recorded just because a repayment has been missed.

Making the monthly repayment is essential

It is important to at least make the monthly repayment for your credit cards. If you positively make payments it will show lenders that you are actively paying your debt.

Keep your credit clean

Maintaining a good credit score has never been more important. More information is being collected and borrowers need to be more careful about their repayments. Responsible lending is key to financial stability. One may argue that CCR is making Australians more vigilant.

The key to keeping a clean credit history is responsible lending and good money habits. Check your credit score. If your credit score is low, then focus on taking the proactive steps to improve it. A low credit score will not only limit your ability to secure a loan, but it will restrict your financial and emotional health.

If you are one of the millions of Australians looking to take out a loan, mortgage or credit card, you will definitely need to make sure that your credit history is clean. The last thing that you want is having a missed Vodafone bill impacting your chance of moving into your dream home. Repairing your credit could make you a much more attractive candidate to lenders when it comes to loans and mortgages. This could lead to better loan terms, lower interest rates and more financial options.

Clean your credit

If your credit score has a default, judgment or blackmark on file; it is key to get it sorted. Ironically, Comprehensive Credit Reporting in Australia has allowed individuals to take more control over their credit file. Credit providers are obliged to take the positive steps to help you get incorrect information on your credit report fixed. The process is arguably long and confusing. Credit repair agencies such as Clean Credit have helped thousands of Australians remove these defaults, judgments and blackmark and subsequently improve their credit score.

If you want to learn more about the new comprehensive credit reporting system or want to enquire about how you could repair your credit score then call Clean Credit now on 1300 015 210 or enquire online