Understanding what factors affect your credit score may seem like a mind-boggling task. The truth is that it is actually super easy.

To understand what factors ruin your credit score, you must understand what your credit score is. In simple terms, your credit score is a summary of your credit information. Credit bureaus such as Equifax have their own scoring system. They gather information from finance and utility providers to calculate a score between 0-1200.

The higher the score, the better your credit file. If you have a high credit score, you’re seen as a more responsible borrower; which in turn means that you will be more likely to secure credit.

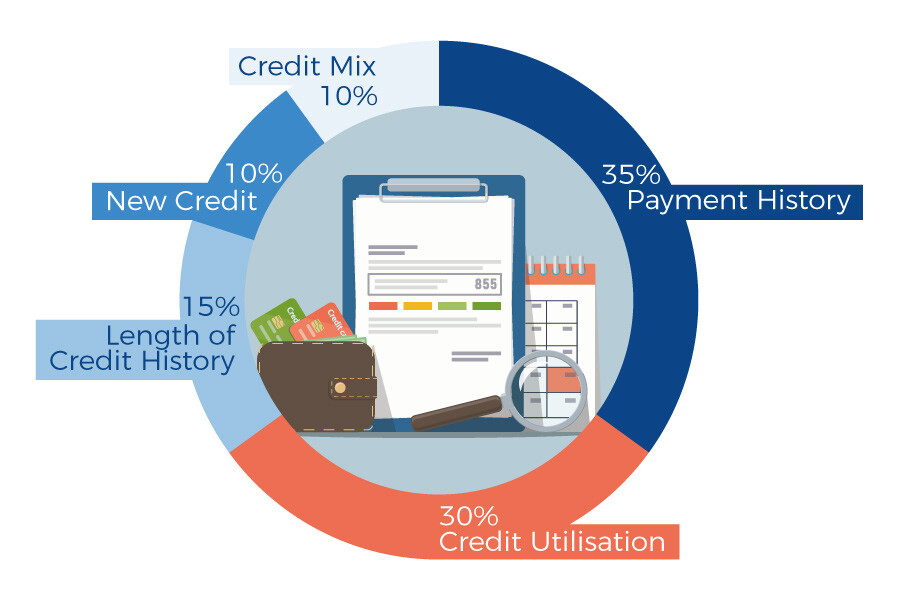

When determining your credit score, bureaus look at five different factors.

Payment History

Payment History

Your payment history is the most important factor in influencing your credit score. Payment history accounts for 35% of your credit score. It is used by most lenders to assess your creditworthiness. If you miss a single loan repayment, credit card bill or utility bill; you can decrease your score.

When assessing your application for credit, a lender will always ask, “Will I get my money back?” Lenders need to be sure that you’re able to manage the repayments. In order to build their case, they will look at your payment history. If you have a positive history they will be more likely to approve your application. If your payment history is flooded with missed loan repayments, overdue credit card payments and utility defaults, they may see you as an irresponsible borrower.

Establishing trust is therefore critical when applying for credit. Positive credit history will only convince lenders that you are more than capable of paying back the loan.

Keep your credit score strong with a solid payment history

In order to improve your credit score, it is important to maintain a strong payment history. Pay bills on time. If you miss a bill, pay it off as quickly as possible. The later you are, the worse off it is for your credit score. If you feel like you have missed a payment, check your credit score to see whether you have any defaults, blackmarks or listings. Do not ignore these credit issues. They may need to be removed if you’re looking to apply for credit.

Credit Utilisation

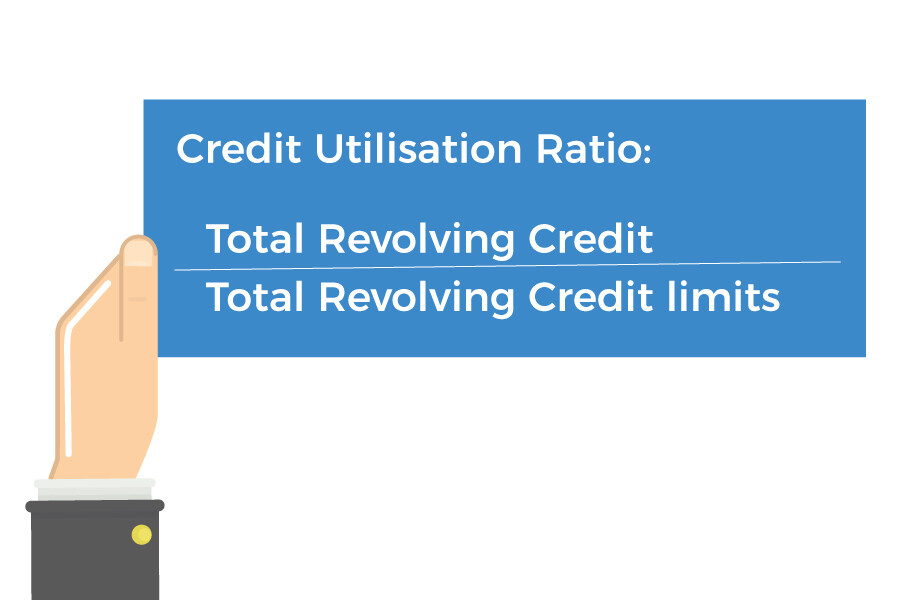

When calculating a borrower’s credit score, lenders will look at your credit utilisation ratio. This is basically, how much of your total available credit you have used. It is based only on your revolving credit which includes your credit cards. Your credit utilisation accounts for 30% of your credit score.

If, for example, you are paying off all your repayments on time, you may not have any more borrowing power. Adding on more debt may only put you in a difficult financial situation. Maintaining a credit utilisation ratio that is less than 30% will show lenders that you are responsible. A ratio that is over 30% may indicate a heavy reliance on credit.

Length of credit history

Have you been paying off credit card accounts for the past 15 years? or are you new to borrowing?

These questions can impact the length of your credit history- another important factor in influencing your credit score. The average length of all your credit accounts reflects for 15% of your credit score.

A high age credit that is clean, will improve your chances of securing credit. If, however, it has late payments and defaults – it will not. Similarly, a short credit history that is clean will also improve your chances of securing credit.

Keep your credit card accounts open

Your length of credit history is counted from the date that you opened the account. At the same time, your credit age is impacted by whether the account is currently active. For this reason, we suggest leaving credit card accounts open, even if they are not in use. If you were to remove long term credit accounts, you may risk decreasing your credit score.

New credit

Have you applied for a number of credit accounts recently? Did you know that each time you apply for a new line of credit, you may temporarily reduce your credit score? The credit score considers how many accounts you have open and how many new accounts you have recently opened.

When applying for credit such as a mortgage, loan or credit card, a lender will make a hard inquiry on your credit file. Essentially they are checking your credit report from one of the major credit bureaus. As these inquiries are linked to a credit application that you have made, they are considered a hard pull.

Lenders look at the number of hard inquiries you have made to better understand your financial situation. A high amount of inquiries may indicate that you are in a sticky financial situation.

Credit mix

The last factor that affects your credit score is your credit mix. Accounting for 10% of your overall credit score, your credit mix factors in;

- The types of credit you have. For example, do you have credit cards, loans, mortgages and store accounts?

- How many accounts have in total?

Together these two factors determine your credit mix. The basic idea behind a good credit mix is to diversify all your credit; so that it is equally spread. A mix of credit demonstrates to lenders that you are capable of dealing with different forms of loans. It is important to note that this does not mean you should apply for different types of loans just to improve your credit mix. Building and managing a mix of credit can however improve your credit score.

The bottom line

Staying on top of your credit score is important if you are looking to utilise credit. Maintaining a good balance of credit, paying your bills on time and keeping your credit utilisation score below 30% and managing your hard enquires will ensure that you build a healthy credit score.